9) DAT – Delivered At Terminal (named terminal at port or place of destination)

This Incoterm requires that the seller delivers the goods, unloaded, at the named terminal. The seller covers all the costs of transport (export fees, carriage, unloading from main carrier at destination port and destination port charges) and assumes all risk until arrival at the destination port or terminal.

The terminal can be a Port, Airport, or inland freight interchange, but must be a facility with the capability to receive the shipment. If the seller is not able to organize unloading, they should consider shipping under DAP terms instead.

All charges after unloading (for example, Import duty, taxes, customs and on-carriage) are to be borne by buyer. However, it is important to note that any delay or demurrage charges at the terminal will generally be for the seller’s account.

10) DAP – Delivered At Place (named place of destination)

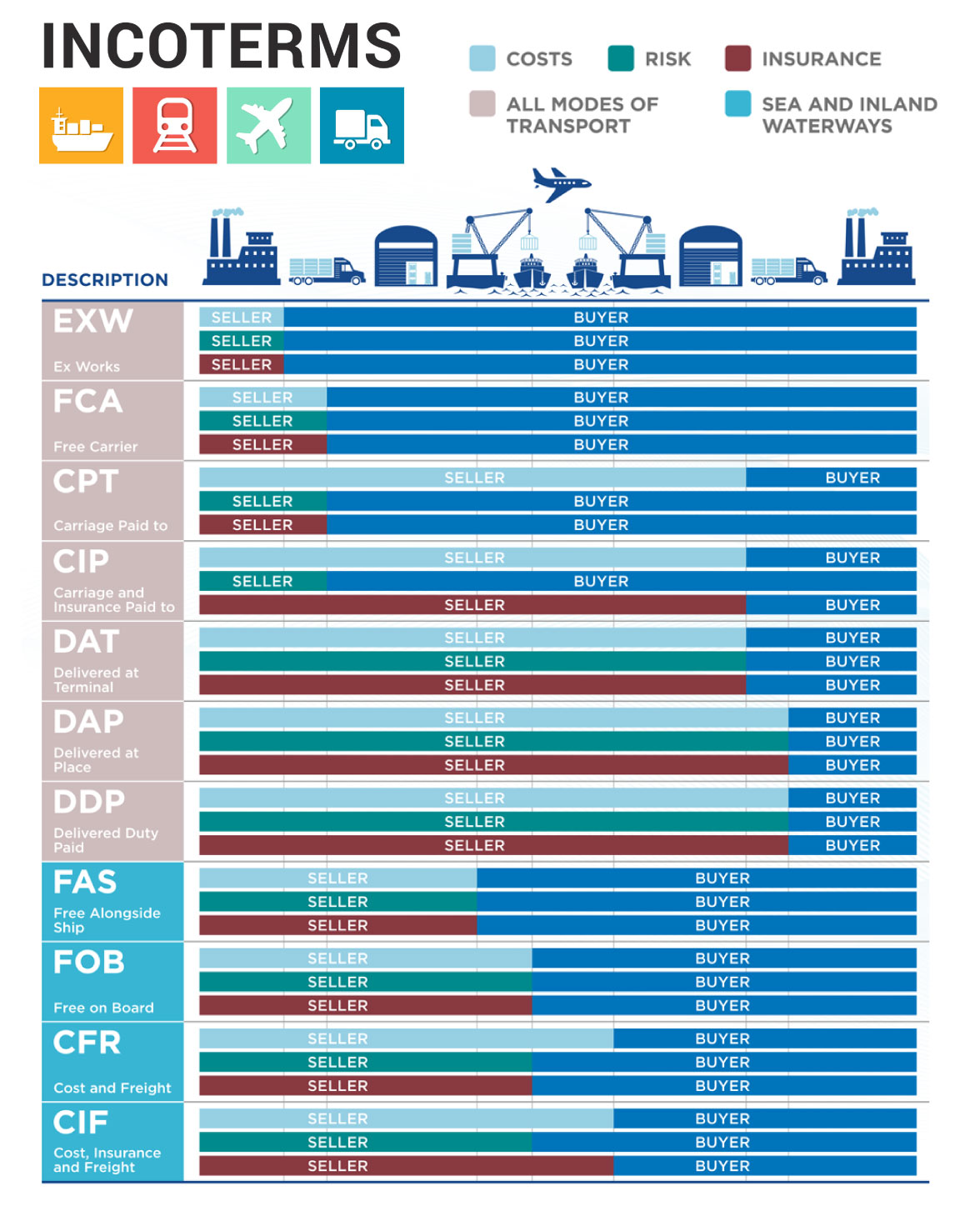

Incoterms 2010 defines DAP as ‘Delivered at Place’ – the seller delivers when the goods are placed at the disposal of the buyer on the arriving means of transport ready for unloading at the named place of destination. Under DAP terms, the risk passes from seller to buyer from the point of destination mentioned in the contract of delivery.

Once goods are ready for shipment, the necessary packing is carried out by the seller at his own cost, so that the goods reach their final destination safely. All necessary legal formalities in the exporting country are completed by the seller at his own cost and risk to clear the goods for export.

After arrival of the goods in the country of destination, the customs clearance in the importing country needs to be completed by the buyer at his own cost and risk, including all customs duties and taxes. However, as with DAT terms any delay or demurrage charges are to be borne by the seller.

Under DAP terms, all carriage expenses with any terminal expenses are paid by seller up to the agreed destination point. The necessary unloading cost at final destination has to be borne by buyer under DAP terms. [15] [16]

11) DDP – Delivered Duty Paid (named place of destination)[edit]

Seller is responsible for delivering the goods to the named place in the country of the buyer, and pays all costs in bringing the goods to the destination including import duties and taxes. The seller is not responsible for unloading. This term is often used in place of the non-Incoterm “Free In Store (FIS)”. This term places the maximum obligations on the seller and minimum obligations on the buyer. No risk or responsibility is transferred to the buyer until delivery of the goods at the named place of destination.[17]

The most important consideration for DDP terms is that the seller is responsible for clearing the goods through customs in the buyer’s country, including both paying the duties and taxes, and obtaining the necessary authorizations and registrations from the authorities in that country. Unless the rules and regulations in the buyer’s country are very well understood, DDP terms can be a very big risk both in terms of delays and in unforeseen extra costs, and should be used with caution.